2.1 The origin of capitalism

PART TWO: NEW VIEW

In the Introduction and in passing in Part I, we promised to introduce the new view on human nature and a new creation story into our globalizing-human coexistence without imposing it upon anyone.

We’re going to do that.

But first let’s talk about our globalizing-human society.

Our globalizing Western society is capitalist.

But if you google ‘capitalism’, you will not find a word about what big money does to a person. Only the invisible hand of Adam Smith: if every entrepreneur strives for his own interests, everything will be fine.

But a Dutch professor, Bas van Bavel, published a book[1] wherein he explains that with the invisible hand of capitalism everything not will be fine. And we don’t need a book for experiencing that since the 1980th, when financial capitalists got free hands, our society tumbled from one crisis to another, with deterioration in Western prosperity.

Marx, Keynes, Friedmann and all other economists don’t know anything about human nature, just like philosophers. Where may we find the roots of capitalism?

In the ‘wild tribes’-phase, starting with the first overpopulation situations? No, that was the phase of the cruel narration of page 60, the phase of the first horticulturers, the phase of the megalithe-festivals (Gobekli tepe p.65) when people tried to create more peaceful ways to deal with the overpopulation stress; the phase of the first trade, the other way of peaceful contacts between the wild tribes.

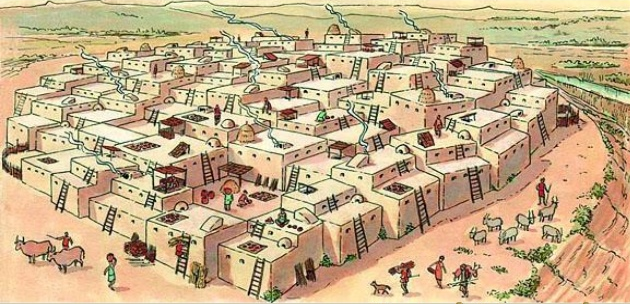

Important trade in the late stone age was obsidian, chunks of volcanic glass with which razor-sharp shards could be made. Find places of this became rich by the barter trade therein and a good example of it is Catal Huyuk (9,400-7,700 BC), excavated since 1958. No trace of capitalism. Only evidence of the peacemaking influence of trade between fighting wild tribes. Catal Huyuk was a really town. But no traces of walls or even palisades. During her 1700 years of existence, Catal Huyuk has retained her complete GH equality between the sexes. No trace of survival battles with other groups. Agriculture and animal husbandry, both women’s inventions, were main sources of existence. The only form of worship that archaeologists have been able to find is a statue of a goddess, found in a storage room of grain, not in a temple or so.

Important trade in the late stone age was obsidian, chunks of volcanic glass with which razor-sharp shards could be made. Find places of this became rich by the barter trade therein and a good example of it is Catal Huyuk (9,400-7,700 BC), excavated since 1958. No trace of capitalism. Only evidence of the peacemaking influence of trade between fighting wild tribes. Catal Huyuk was a really town. But no traces of walls or even palisades. During her 1700 years of existence, Catal Huyuk has retained her complete GH equality between the sexes. No trace of survival battles with other groups. Agriculture and animal husbandry, both women’s inventions, were main sources of existence. The only form of worship that archaeologists have been able to find is a statue of a goddess, found in a storage room of grain, not in a temple or so.

Even in the Harappan civilization of the Indus Valley (2600–1900 BC) we cannot find an archeological trace of capitalism. And do not make me believe that it was not a flourishing trade community. It was a community with archeological evidence of a priestly man and a dancing girl and seals that can be seen as kind of money, as an efficient alternative to primitive barter trade. But even in this flourishing society no trace of inequality or private property, no trace of palaces or temples, in short no trace of power. Only abundant traces of welfare.

Ownership, property, greed, stage I and II behavior are all inherent to capitalism, but not to trade or market. They are also not specific to money. Money is the ideal universal medium of exchange, trade and market easing. Nor are they specific to production or service; these are just ways to make money.

Ownership, property, greed and other stage I and II behavior are even not inherent to too much money if this serves as a provision for the old age or for incapacity for work. Yes, not even if you lend too much money to someone who is short of cash.

It only becomes capital as soon as you start to make more money from your too much money.

You can do that by lending your too much money to interest.

Judaism and Christianity and Islam were always against that. They regarded it as usury. But as soon as capitalism started to play a role in their societies, all three monotheisms were able to find their way out. Where Christian bankers initially could not calculate interest, people went to Jewish bankers, because those were allowed to do so to non-Jews. The Church itself went wrong with indulgence-trading, which caused a rupture. But also with the Protestants, the practice proved to be stronger than the doctrine.

When does the coin appear?

As soon as the exchange of one product against another plays a major role, one looks for something universal that is valuable to all parties and that is not perishable. For example, shells or salt.

Photo: kauri shells

But if you live by the sea, it is too easy to be rich, and salt is difficult to keep dry.

It seems that the Lydians (on the south coast of present-day Turkey) were the first with coins. They used as a universal exchange tool electrum, a natural mixture of gold and silver that they found in a small river. They melted it and poured it into drops which they rounded and provided with a stamp on both sides. Voila, the first money.

The neighboring Ionian city states took it as the better alternative to shells or salt. Because the contents of gold and the cheaper silver could differ quite a bit in the Lydian coins, they were now minted in either gold or silver. Later, a cheaper copper coin was added to the file, and since then the successful merchant has been characterized by his leather pouch with coins. Which of course attracts robbers, pickpockets and burglars.

Minting is blacksmith work. Also the manufacture of safes. That work was not something for an ordinary village farrier. The goldsmith could hear to the sound how pure a coin was when he dropped it on a table. The same experience had the money changer, and not only by listening to the sound when dropped on his banca (tabletop) but also by weighing.

Both were well protected against robbery and burglary, and more and more merchants kept their coin supply with them instead of converting their houses into bunkers. The banca owners took the money in custody for a fee and the merchant received an exchange bill of parchment as proof, stating the amount of gold and silver and the name of the banca owner.

The merchant felt safer when he set off for the owner of a piece of land near a river where the merchant wanted to start a shipyard. The landowner trusted the bill, and indeed he could get the amount of gold and silver from the banca owner in exchange for the piece of land.

However, the landowner preferred to leave the large amount of money to the bank (much safer), and went with the bill to a contractor for a new house.

And he … anyway, the bills began to fulfill the role of our banknotes: a lot safer than walking around with bags of gold and silver.

The system was based on the confidence that the banker would indeed give the right amount of gold or silver if the holder of a bill asked for it.

After the invention of printing, the bills of beautifully printed paper also became available. Banknotes: fiduciary (trusting in good faith) money. The paper value was a pittance of the value stated on gold or silver. And only rarely did anyone ask for cash.

People deposited not only their excess money, also people borrowed money from the bank. The banker demanded interest for it, far more than the fee for depositing. The banker liked to lend money. Especially big money: paper money. As always, the opportunity makes the thief. The banker lended far more paper money much more than he kept gold and silver in his safe. The people trusted that they could still exchange their banknotes for cash.

Until, even if only through a rumor, a bank run arose …

Making more money from your too much money can also by gambling. But that almost always goes wrong. A less risky form of gambling is investing in shares, or speculating with it. Shares!

After the Middle Ages, trade in Europe flourished again. First in the Italian city-states of Venice, Florence, Genoa and Siena, with all the splendor: architecture, artists, scientists and poets. Followed by the Portuguese, with voyages of discovery on increasingly seaworthy ships, and then the Spaniards. Until the Dutch experienced their Golden Age (1600-1700) and the English after them starting their ruling the waves.

Yes, we are talking about ships. These are, just like bridges or railroads, capital goods for building that you cannot lend at a single bank. A lot of people have to make a share of this. Shares!

A Dutch invention. the Seven Provinces had fought loose from Spain and started a polder republic. On the seas, their barges were supreme, they picked up many Portuguese and Spanish colonies. In 1602, the VOC (the Dutch East India Company) was established and for the required ships, it issued shares for a large public. Anyone who, thanks to the thrift and / or exploitation of poor drudges, had gained more money than he needed for living, could now make more money from that money. But it remains gambling. If the voyage of the merchant had been successful, the investor could see his share multiplied. But ships can also perish and then … money away.

What is the major disadvantage of this way of making money with money? Entrepreneurs are accountable for their social responsibility: the degree of exploitation of their employees, the environmental damage, their tax liability. But shareholders are only interested in the return on their share.

At the end of the 70s the stakeholder model was replaced by the shareholders model. From now on the bad dog of finance capital clung to the leg of the free market. From now on, the process of moving employment to low-wage countries began at the expense of employment here.

What? Shareholders the real owners of the company? The gamblers owners of the fruit machine or the casino? The creator of that idea, Jack Welch, regretted it at the end of his life as the stupidest idea ever. But the idea is still alive today.

Big money corrupts, just like power. It throws people back in stage I of their human nature. Wrong stuff. Hedgefunds and more of those gambling systems and tax-rulings, get away with it! Bring us only crises, environmental damage, accident. People have birthright on GH satisfaction.

… But wait a moment.

That bad dog on free markets leg of finance capital, causing crises and breakdown of the welfare state here and causing globalization of the free market, has also caused many people in those low-wage countries to be lifted from the deepest poverty!

Perhaps that bad dog is the modern-day version of the cruel warriors of the Iron Age who united and civilized the “tribes” as slaves within their empire. Perhaps our crises are the contemporary version of the horrible religious wars.

Civilization has no other option than to move along this horrible road. Today we didn’t still not totally surpass the “wild tribe” phase of the overpopulation when we started to breed as AMHs. We still have a huge job to do before we have regained the ancestral harmony. We are only at the beginning of the realization that we as humans have ever lived together in this harmony.

So just leave the bad dog alone?

Oh no, because then mankind does not even fulfill the 2015 climate appointments of Paris, just to name a few. But ever more people take action against the bad dog. Piketti, Panama Papers, Paradise Papers, Gabriel Zuckmann’s plan for making the tax avoidance of the multinationals, the Follow This shareholders group of Shell: the number of people and groups of people is growing.

And we, humanosophers, also want to contribute something.

Okay, we have already made a nice contribution in the above by solving the problem of the origin of human language, the problem of why we are the only species that is using fire, the problem of the birth of God and religion, the problem overpopulation and of male dominance, etc.

But for now we want to contribute two things. A new idea for the organization of democratic elections. And a new belief.

- The Invisible Hand (2016) ↑